Best Fintech Software Development Companies: Top 10 Picks!

The fintech software development sector is rapidly evolving and gaining global recognition due to the increasing reliance on mobile devices, which is propelling the financial industry to new heights. Nonetheless, creating a financial application can be a challenging endeavor, demanding extensive technical proficiency and insight. That’s why this article was written. In this article, we will spotlight the best fintech development companies and explain the process of selecting the appropriate financial software partner for efficient and economical development. Let’s explore further!

Overview Of The Fintech Software Development Market Value

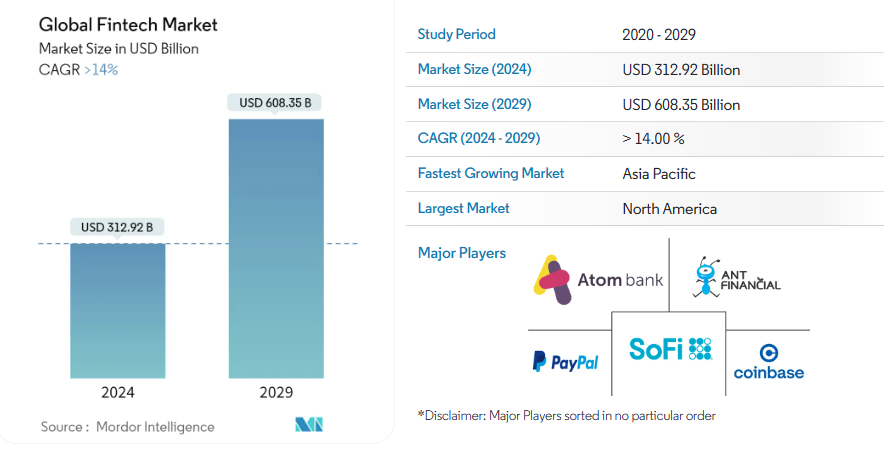

Mordor Intelligence, a respected market research and consulting company, specializing in providing precise market information and advice to businesses globally, has projected the Global Fintech Market to grow substantially. In 2024, it’s estimated at USD 312.92 billion, with an expected increase to USD 608.35 billion by 2029. This growth, anticipated at over 14% annually from 2024 to 2029, stems from several key factors.

Detailed forecast table of the Fintech market from 2020-2029. Source: Mordor Intelligence

Firstly, the widespread use of smartphones and internet access has propelled the market forward. Secondly, technological advancements like AI and blockchain have created fresh avenues for fintech innovation, fueling market expansion. Moreover, regulatory adjustments have leveled the playing field, enabling fintech firms to vie with traditional financial institutions.

Struggling to find the best IT outsourcing tech partner?

Look no further! At Savvycom, we take pride in being one of the top IT software outsourcing providers. Reach out to us, and we’ll assist you in selecting the perfect software development service tailored to your business needs and requirements.

Key Considerations Of Fintech

So, what makes Fintech application development crucial in the digital age? Here are the key factors we’ve identified:

- Efficiency and Convenience: Fintech transforms financial transactions, making them simpler and more convenient. Through fintech software, users seamlessly manage funds, transfer money, and invest via digital platforms and mobile apps. This innovation removes complexities, enabling individuals to navigate financial services efficiently in the digital era.

- Data-Driven Decision Making: Data analytics and insights are the real MVPs. By tapping into the magic of data, financial tech companies can make smart moves. This means they can spot risks, dodge fraud, and choose investments wisely.

- Cost Savings: Fintech solutions help both businesses and consumers save loads of money through automation and smoother processes. When banks ditch the brick-and-mortar branches, they pass on the savings to us with lower fees and juicier interest rates. It’s like getting a financial upgrade for everyone involved!

- Customer Personalization: Custom financial software development has become the secret sauce for personalized user experiences. Fintech companies use data insights to craft financial services that feel tailor-made, sparking interactions that truly speak to individual needs. By tapping into the magic of data, they turn transactions into memorable adventures, boosting customer satisfaction and loyalty along the way.

- Lending and Credit Scoring: By diving into alternative credit scoring models, fintech platforms analyze out-of-the-box data sources—think social media activity and online behavior. This detailed insight allows lenders to better gauge a borrower’s creditworthiness, ushering in a new era of well-informed lending decisions.

- Financial Inclusion: Fintech’s tech wizardry is key to including everyone financially, especially those left out. Think digital banking, mobile pay apps, and peer-to-peer lending – they’re like magic wands for folks in remote areas or facing financial hurdles. With fintech, they can finally tap into vital financial services, boosting economic participation and stability.

Regarding the benefits of Fintech for businesses and individuals today, there are many more noteworthy points, but the six main points mentioned above capture the interest of individual users and businesses alike.

Best Fintech Software Development Companies: Top 10

In this section, we’ll delve into the top 10 Best Fintech Software Development Companies.

Savvycom

Savvycom is a leading IT outsourcing company

Savvycom claims the prestigious first position among the Top 10 list, recognized as a reputed IT Outsourcing company. As an industry leader, they revolutionize fintech consulting services, particularly in Fintech software development. Renowned for their exceptional prowess, Savvycom stands out for crafting cutting-edge solutions that redefine the financial technology landscape. Their expertise extends to various Fintech solutions, including robust banking software, secure payment gateways, and innovative blockchain-driven financial platforms.

Additionally, they provide solutions for various fields, such as fintech solutions for banks, digital healthcare, and education. With a relentless commitment to technological excellence and unparalleled ability to navigate Fintech complexities, Savvycom sets new benchmarks, driving the evolution of digital finance with visionary contributions.

Yalantis

Unlocking your business’s potential, one line of code at a time

At Yalantis, innovation blends with precision to redefine the fintech landscape, and their mission is to create software that seamlessly marries intuition and power, empowering businesses across supply chain, healthcare, and real estate domains. With over 16 years of development expertise, 500+ specialists craft solutions that resonate with users. From intuitive interfaces to robust functionality, Yalantis is committed to delivering excellence. Headquartered in Larnaca, Cyprus, and with development hubs in Ukrainian cities like Dnipro, Kyiv, and Lviv, Yalantis stands at the forefront of fintech evolution. Trust Yalantis to turn your vision into reality.

Trango Tech

Elevate your efficiency with seamless IT outsourcing solutions

Specializing in crafting scalable and secure fintech payment solutions, Trango Tech empowers businesses to thrive in a fiercely competitive market. From seamless payment gateways to robust blockchain applications, Trango Tech stands at the forefront of technological advancement. Their arsenal includes cutting-edge tools like Python, Java, and Ethereum. However, it’s not just about code; it’s about transforming ideas into reality. With a commitment to excellence, Trango Tech serves as a trusted partner in the fintech revolution, offering end-to-end services tailored to meet diverse digital needs.

Unified Infotech

Let us handle the tech, while you focus on what truly matters

Unified Infotech is a reliable partner for both startups and enterprises, offering comprehensive software development solutions that foster financial growth. Committed to delivering excellence, we provide customized end-to-end services, steering businesses toward digital prosperity. Our expertise covers a wide array of cutting-edge technologies including Web Development, Mobile App Development (creating scalable and user-friendly mobile applications), and Custom Software Development (tailoring solutions to meet specific business needs). Through these advanced technologies, Unified Infotech enables clients to efficiently accomplish their digital goals.

SMT Labs

Outsource your IT woes, embrace endless possibilities

Founded in 2017, SMT Labs is a leading fintech software outsourcing firm. Specializing in custom solutions, they assist businesses of all sizes in overcoming intricate financial hurdles. Their dedication to embracing emerging technologies ensures the delivery of innovative solutions that align with evolving industry needs. SMT Labs offers advanced technologies and services, encompassing custom software and mobile app development. With a focus on excellence and client satisfaction, they empower businesses to thrive through technological advancement. As a dependable partner in the fintech industry, SMT Labs provides tailored solutions tailored to modern financial landscapes.

IBR Infotech

Transforming challenges into opportunities through IT outsourcing

IBR Infotech leads in financial software development, offering customized solutions for diverse business requirements. Committed to excellence and client satisfaction, IBR Infotech is a reliable partner for enterprises seeking innovative fintech solutions. Through close collaboration, they understand client challenges and goals, aligning solutions with their vision. Utilizing the latest technologies and industry best practices, IBR Infotech ensures businesses stay competitive in dynamic markets.

EPAM Anywhere

Empowering your business with tailor-made IT outsourcing strategies

EPAM Anywhere opens doors to remote work opportunities for tech professionals worldwide. Emphasizing flexibility and growth, it delivers full-scale software development services, encompassing fintech solutions across diverse markets. Collaborating closely with startups and SMBs, EPAM Anywhere harnesses the collective expertise of thousands of IT professionals to spearhead innovation and ensure sustained success in the fintech arena. Renowned for its unwavering commitment to quality and innovation, EPAM Anywhere cultivates a supportive community where tech experts flourish, extending remote job opportunities to over 20 countries.

LeverX

Reliable IT outsourcing: Your gateway to innovation and growth

LeverX stands out for its expertise in seamlessly integrating SAP solutions with fintech innovations, optimizing financial processes for businesses. Leveraging its deep SAP knowledge, LeverX boosts efficiency and accuracy in financial operations, empowering companies to succeed in dynamic markets.

Furthermore, LeverX prioritizes robust cybersecurity measures, ensuring the utmost data protection. With a comprehensive suite of preventive processes, they safeguard sensitive information, earning trust and reliability from clients.

Thus, LeverX acts as a strategic partner, guiding digital transformation journeys with a focus on security and efficiency in financial technology solutions.

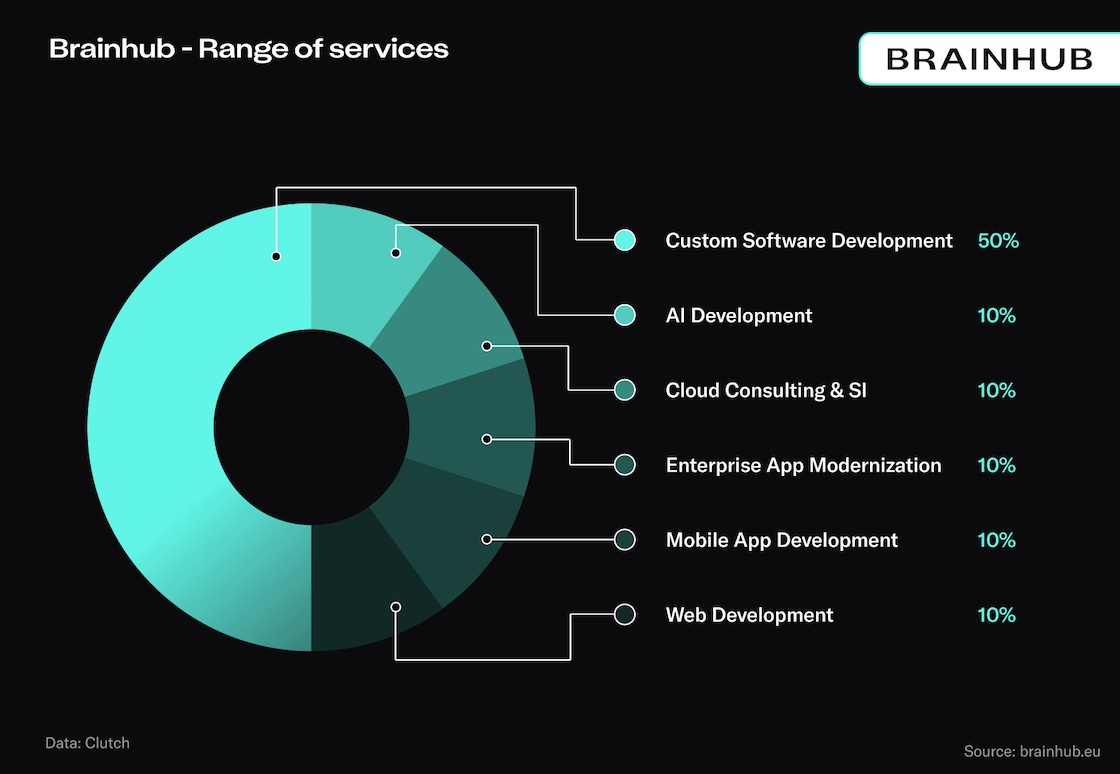

Brainhub

Streamline operations, amplify productivity – with IT outsourcing

Brainhub is a top fintech software outsourcing company known for its expertise in .NET and JavaScript technologies. Their specialty lies in creating reliable and user-centric fintech applications, catering to various needs like crypto-trading, expense management, and wealth management. Brainhub collaborates with startups, SMEs, and corporations to deliver exceptional fintech web and mobile app solutions. With a focus on enhancing customer engagement and ROI, they leverage their strong UX design skills. Brainhub also offers discovery workshops to streamline development processes and ensures cybersecurity through robust preventive measures.

10Clouds

Your trusted partner in navigating the digital landscape

Joining the ranks of today’s top contenders is 10Clouds, standing tall in fintech development outsourcing innovation. With a dynamic portfolio embracing blockchain and cryptocurrency ventures, the company excels in fintech and blockchain software development and consultation, prioritizing intuitive solutions for users. Teaming up with Trust Stamp, a global authority in identity verification, 10Clouds champions robust security standards across its offerings. Notably, solutions like proof of liveliness and ID verification streamline operations for enterprises and fintech entities. Moreover, 10Clouds’ fintech unit collaborates with partners, bolstering blockchain and mobile development endeavors, and facilitating seamless transitions to cloud infrastructure.

How To Choose Fintech Solution Providers That Fit Your Demands

Now that we’ve explored the top contenders among IT outsourcing companies, which partner feels like the perfect fit for you? Let’s dive into some helpful pointers for choosing the right collaborator.

Well, choosing the right fintech software development company is a pivotal decision with far-reaching implications for your business. Here’s a breakdown of key factors to weigh when selecting a fintech solution provider:

- Track Record: Assess the company’s history and credibility in delivering effective fintech solutions. Explore client testimonials, reviews, and case studies to gauge their past performance.

- Expertise in Latest Technologies: Ensure the provider stays abreast of cutting-edge technologies like blockchain, AI, and cloud computing, essential for fintech innovation.

- Regulatory Knowledge: Confirm the provider’s grasp of regulatory standards in the fintech sector, ensuring compliance with legal requirements.

- Scalability and Security: Evaluate the provider’s capacity to deliver scalable, secure solutions adaptable to your business’s growth trajectory and safeguarding sensitive financial information.

- Understanding of Business Model: Opt for a provider attuned to your business model and the intricacies of the financial services landscape.

- Portfolio and Case Studies: Scrutinize the provider’s portfolio and case studies to gauge their experience, expertise, and success in delivering fintech solutions.

By considering these factors, you can pinpoint fintech solution providers aligned with your business requirements, fostering fruitful collaboration and innovation in the fintech realm.

Conclusion

Selecting the ideal software and app development company for your fintech project demands careful consideration. The outcome of your endeavor hinges on a successful, compliant, and secure fintech product. Therefore, exercising due diligence in your selection process can pave the way for a fruitful partnership that yields long-term benefits for your business. If you’re willing to invest the time and effort into making a prudent choice, refer to the accurate list of top 10 best Fintech software development companies provided above, along with our advice on selecting the right IT outsourcing provider. By adhering to these guidelines, you can ensure that your fintech project is in capable hands, poised for success in the dynamic landscape of financial technology.

Explore the Power of Digital Healthcare Technologies with Savvycom!

From Tech Consulting to End-to-End Product Development and Software Outsourcing Services, Savvycom has been leading the charge since 2009. Our expertise in Digital Healthcare Technologies has driven business growth across diverse industries. Let us assist you in crafting top-notch software solutions and products, along with a comprehensive suite of professional services tailored to your needs. Partner with Savvycom and unlock the full potential of your healthcare endeavors today!

Savvycom is right where you need. Contact us now for further consultation:

- Phone: +84 24 3202 9222

- Hotline: +84 352 287 866 (VN)

- Email: [email protected]